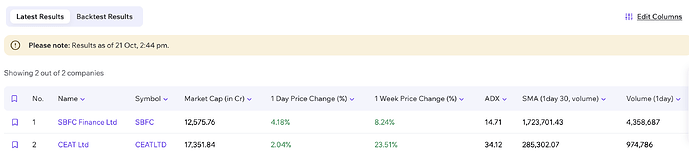

I made a screener with the below conditions:

→ Quarterly net profit growth ≥ 25% YoY

→ Price closes above 14-day EMA

→ RSI > 60

→ Volume ≥ 30-day averageLatest results as of yesterday’s special trading session:

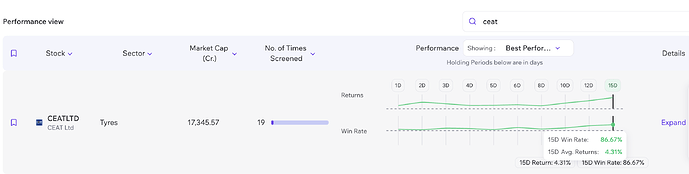

I then checked out backtested results and CEAT seemed like a favorable one for a swing trade. With an 86% win-rate, the avg return over 15 days of holding is over 4%.

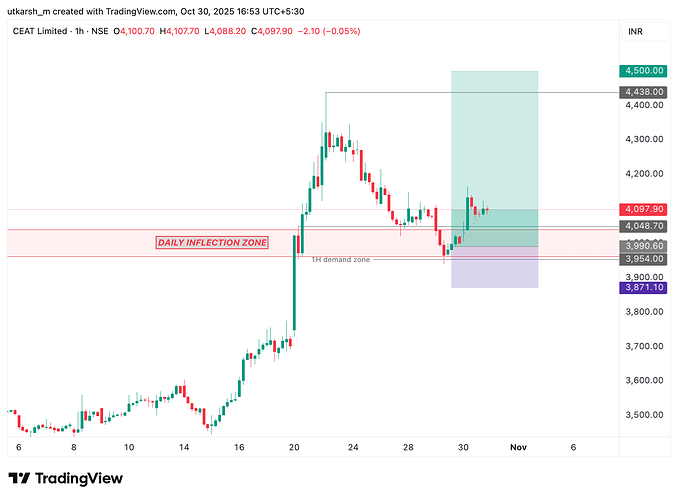

Since the stock has rallied a lot in the last couple of sessions, I’m waiting for some sort of pullback and will then plan an entry on lower timeframes, targeting between 3-4% depending on market conditions at the time.