![]() Screener Conditions

Screener Conditions

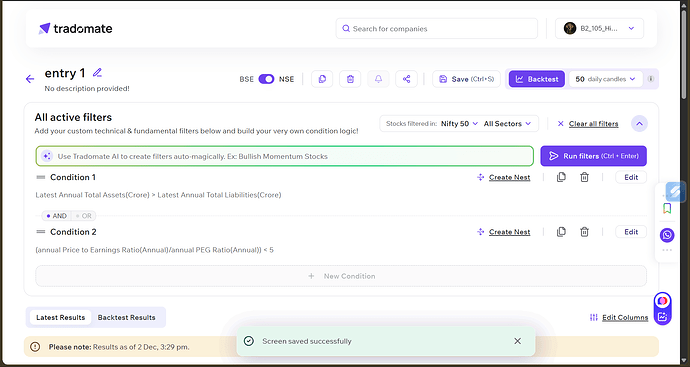

Condition 1:

Latest Annual Total Assets (₹ Crore) > Latest Annual Total Liabilities (₹ Crore)

Condition 2:

(Annual Price-to-Earnings Ratio / Annual PEG Ratio) < 5

Logic Behind Choosing These Conditions

Logic Behind Choosing These Conditions

These conditions help identify financially strong, fundamentally stable, and attractively valued companies. Here’s the reasoning:

Condition 1: Assets > Liabilities

Condition 1: Assets > Liabilities

This is a direct measure of balance-sheet strength.

Companies with more assets than liabilities:

-

Have lower financial risk,

-

Maintain better solvency,

-

Can survive market downturns,

-

Have a solid foundation for long-term growth.

This filter ensures you only select businesses with healthy financial positions and stable capital structures.

Condition 2: (PE Ratio / PEG Ratio) < 5

Condition 2: (PE Ratio / PEG Ratio) < 5

This is a blended valuation and growth filter.

-

PE Ratio → price you pay for earnings

-

PEG Ratio → valuation adjusted for growth

By comparing PE with PEG, we pick companies that are:

-

Potentially undervalued,

-

Growing at a reasonable or high rate,

-

Offering better earnings potential relative to their price,

-

Showing signs of being mispriced by the market (good for investors).

This helps select companies that are not only cheap but also growing — giving both value + growth benefits.

Backtest Results (Based on Your Screenshot)

Backtest Results (Based on Your Screenshot)

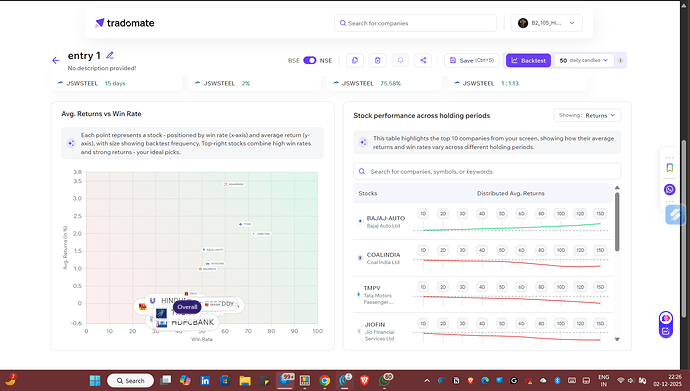

Here’s the summarized performance of your screen over the last 50 daily candles (~4 months):

Best Performing Stock: JSWSTEEL

Best Performing Stock: JSWSTEEL

-

Holding Period: 15 days

-

Average Return: 2%

-

Win Rate: 75.58%

-

Risk–Reward Ratio: 1 : 1.13

JSWSTEEL stands out as the most consistent performer, combining strong returns with great win rate and stable distribution across holding periods.

Avg. Returns vs Win Rate (Overview)

Avg. Returns vs Win Rate (Overview)

-

Top-right stocks on the scatter plot show both high win rate & high returns.

-

JSWSTEEL and TITAN are among the strongest picks.

-

Stocks like BAJAJ-AUTO show steady upward distributed returns, confirming stability.

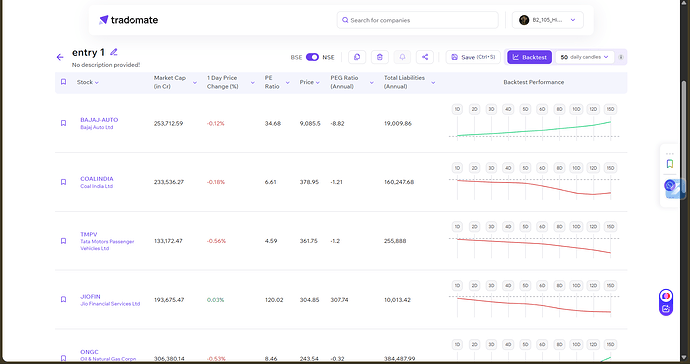

Stock Performance Across Holding Periods

Stock Performance Across Holding Periods

From your list:

-

BAJAJ-AUTO → steady green trend across periods

-

JSWSTEEL → upward-sloping return profile

-

COALINDIA / JIOFIN / ONGC → weaker performance with red trends

-

Tata Motors Passenger Vehicles (TMPV) → mixed performance, leaning weak on longer holding periods