Took a trade on Vedanta after a few things lined up well.

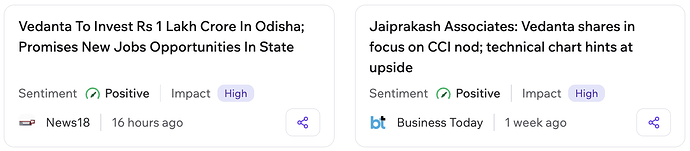

1: The recent news flow has been quite positive. Last week’s acquisition of Jaiprakash Associates and the announcement of a ₹1 lakh crore investment plan in Odisha both added to the bullish sentiment around the stock. It’s clear the company’s been in focus for the right reasons lately.

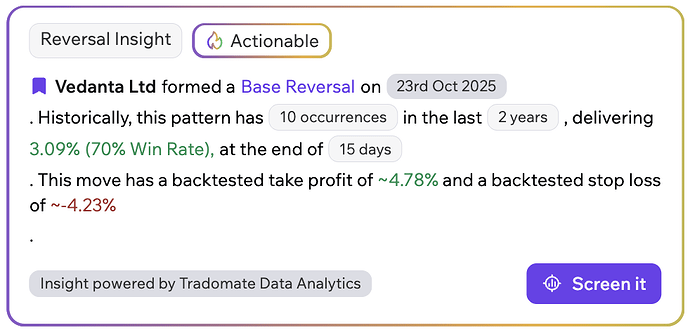

2: A Base Reversal insight was also generated on 23rd Oct, showing a 70% win rate with a 4.78% backtested target. That added more conviction since it aligned perfectly with what the price structure was already suggesting.

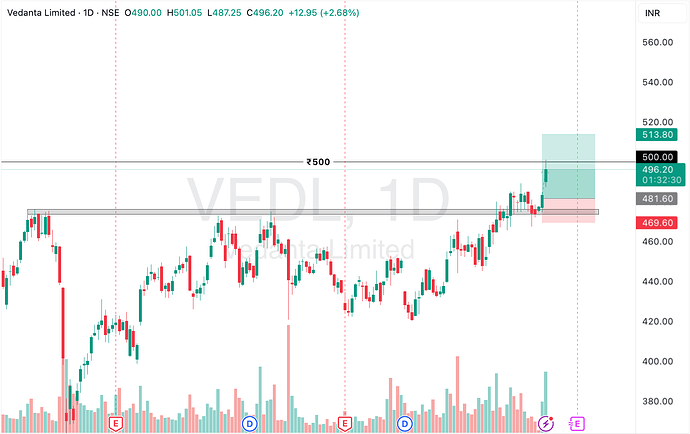

3: Technically, Vedanta had retested the previous resistance zone near 475 and bounced sharply with high volumes. I entered soon after noticing that retest.

I just took partial profits today around 500, which had been acting as a strong psychological resistance, and am holding the rest for a potential move towards 520, close to the all-time high. The follow-through so far has been strong, and if broader market sentiment stays supportive, the breakout could extend further.

Key takeaway: Combining news flow, quant signals, and technical analysis = high conviction trades.

Would love to hear how others approach similar setups!

Are you tracking Vedanta or trading breakouts lately? Drop your views below