So Indigo’s situation is getting worse by the day… nearly 500 flights cancelled today as well because of crew shortages tied to the new FDTL norms. The article says the airline basically miscalculated crew requirements, and that’s now messing up on-time performance + operations pretty badly. DGCA has stepped in and asked them for a full mitigation plan.

Honestly, for a company that has 60% market share, this kind of disruption is huge. If this drags on till Feb 2026 (which is what they’re targeting for stabilisation), the next couple of quarters might look rough.

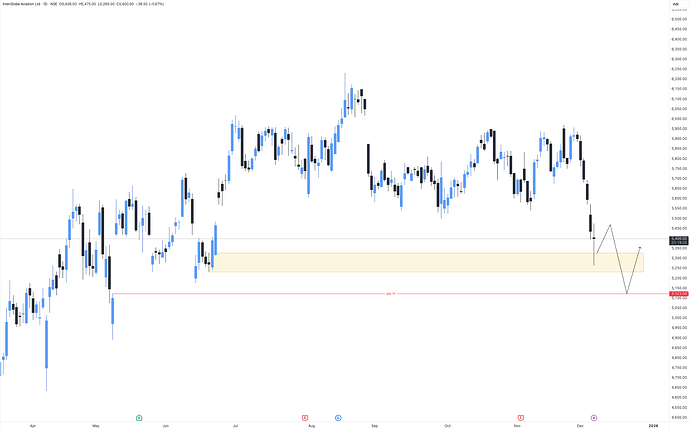

Chart-wise:

I’ve marked a demand zone around the ₹5250-₹5320 area. Price is sliding straight into it with no slowdown yet. If this zone holds, we might see a short-term bounce. But if that level cracks, the next clean support is much lower, and the structure starts looking bearish for a while.

Right now it feels like one of those “wait and watch” situations-

bad news flow + a technical breakdown usually isn’t a great combo.What do you guys think? Is this a buy-the-panic opportunity, or does Indigo have more downside before things stabilise?

2 Likes

With government intervention and general regulatory confusion around what is next for the aviation industry, looks like Indigo can fall down further. Tracking it carefully- might enter longs soon

1 Like